Because of that link substantial and long lasting.

Does inverted yield curve mean recession.

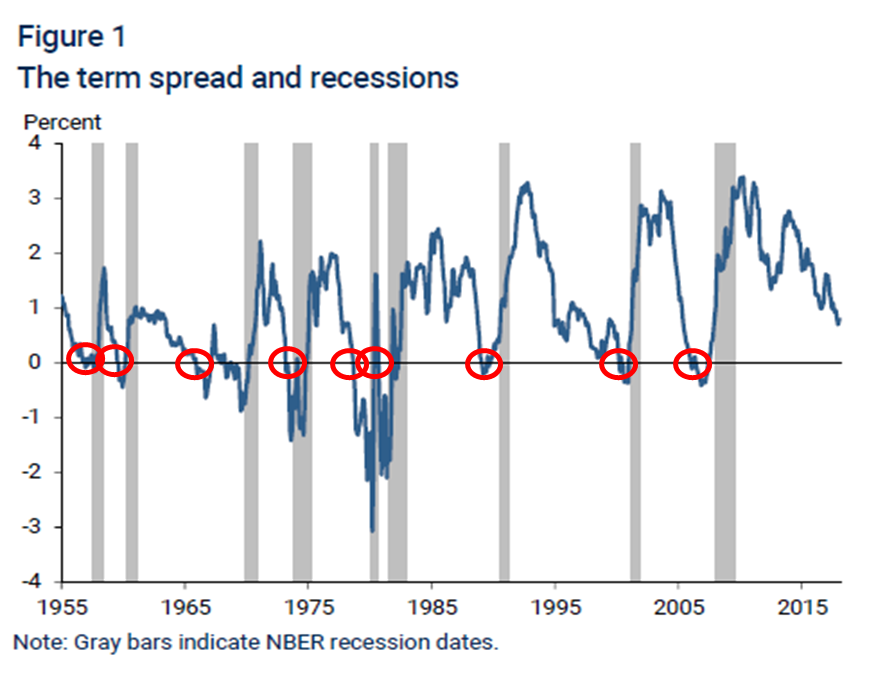

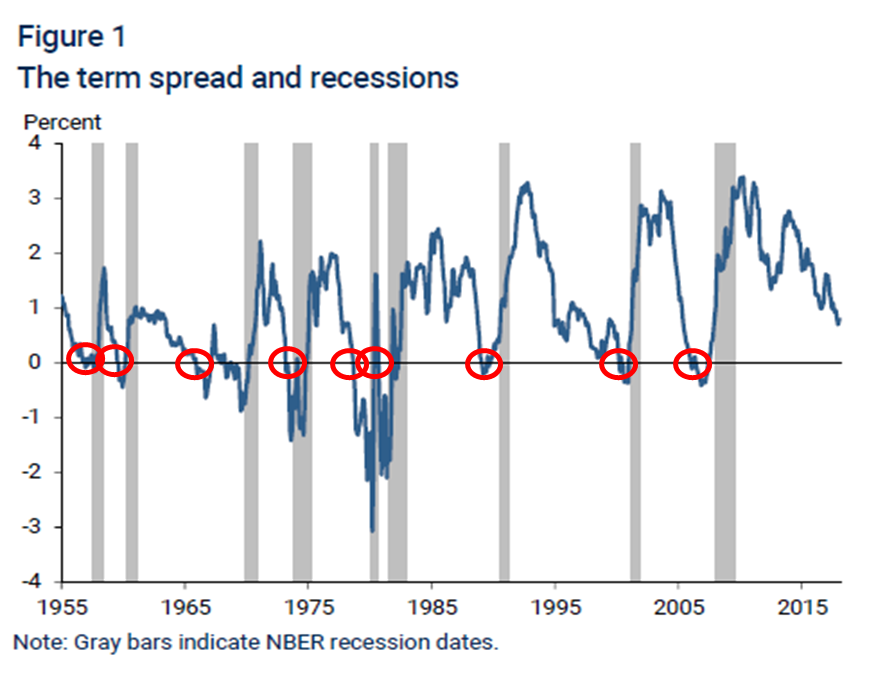

The yield curve has inverted before every u s.

When the inverted yield curve last forecast a recession the treasury yield curve inverted before the recessions of 1970 1973 1980 1991 and 2001.

An inversion of the most closely watched spread between two and 10 year treasury bonds has.

Inverted yield curves in the us and elsewhere tell us very little about the timing of future downturns and for now at least the economic data are more consistent with a slowdown than a downturn.

Inverted yield curves are an essential element of these cycles preceding every recession since 1956.

Let s take a look at the history of the connection between recession and yield curve inversion to help us.

An inverted yield curve for us treasury bonds is among the most consistent recession indicators.

An inverted yield curve is an interest rate environment in which long term debt instruments have a lower yield than short term debt instruments of the same credit quality.

The yield curve also predicted the 2008 financial crisis two years earlier.

Curve has inverted before each recession in the past 50 years.

It offered a false signal just once in that time.

Considering the consistency of this pattern an inverted yield will likely form again if the.

What does a yield curve inversion mean and what might it indicate for the u s.

Recession since 1955 although it sometimes happens months or years before the recession starts.