The investment objective and policy of this sub fund is to achieve capital appreciation in the medium to long term by investing in a portfolio of sharia observant equity and equity related securities including without limitation depositary receipts and convertible securities but excluding preferred shares bonds convertible bonds and warrants listed or traded on recognised exchanges of companies engaged in activities related to gold silver platinum or other precious metals or minerals.

Deutsche gold and precious metals fund fact sheet.

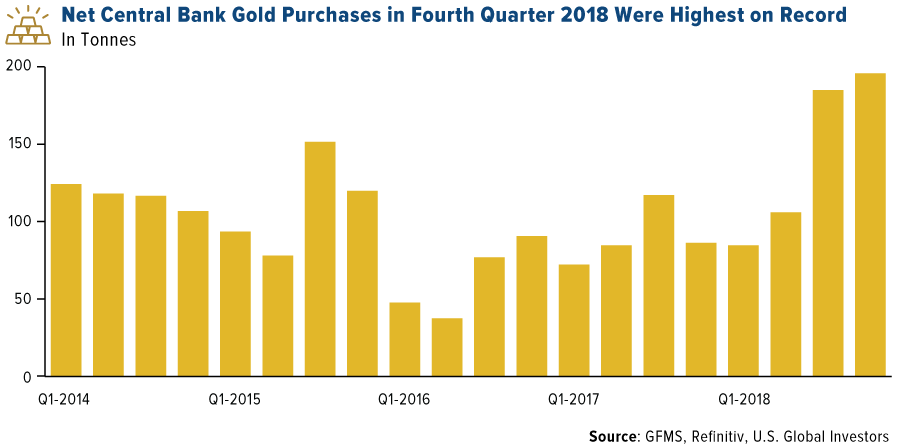

Cef provides investors with exposure to both precious metals at a time when demand is very high and access is becoming more difficult due to disruptions in the global mining supply chain.

An active fundamental approach focused predominately on gold precious metal mining company equities trading at attractive valuations.

The fund s objective and strategy also changed at.

The strategy and management team also changed at that time.

Franklin gold and precious metals fund fact sheet author.

Prior to 9 23 19 this fund was known as dws mid cap value fund.

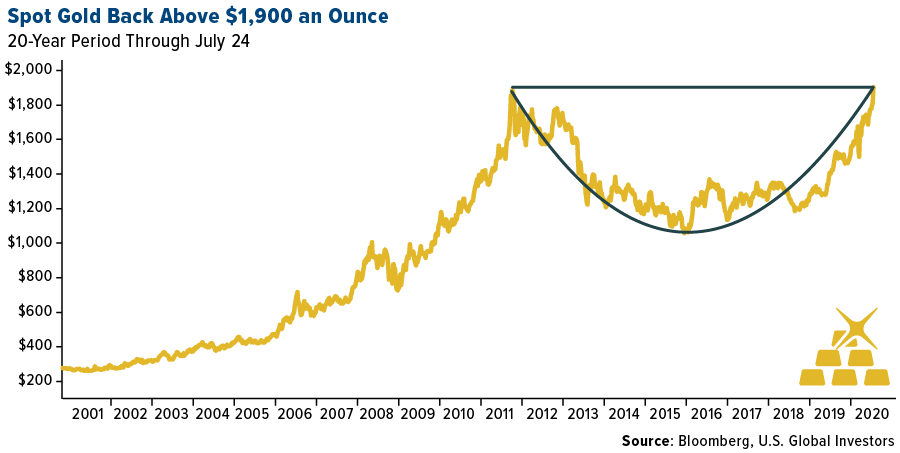

Platinum was the only precious metal that had a negative return of 1 02.

As of 08 31 2020 the fund had an overall rating of 4 stars out of 60 funds and was rated 5 stars out of 60 funds 5 stars out of 59 funds and 3 stars out of 47 funds for the 3 5 and 10 year periods respectively.

Our team brings valuable background in geology and mining finance important to understanding the technical side of the business.

The sprott physical gold and silver trust nyse arca.

Cef currently holds approximately 1 442 million ounces of gold and 60 395 million ounces of silver.

About the gold and precious metals fund.

The fund is designed for investors who want a cost effective and convenient way to invest in commodity futures.

Gold and precious metals equities as measured by the s p bmi gold and precious metals index non sharia compliant gained 6 12 during the period.

1dbiq optimum yield precious metals index tr 2the s p gsci precious metals index is a world production weighted index consisting of two precious metals commodities in the world economy including futures contracts for gold and silver.

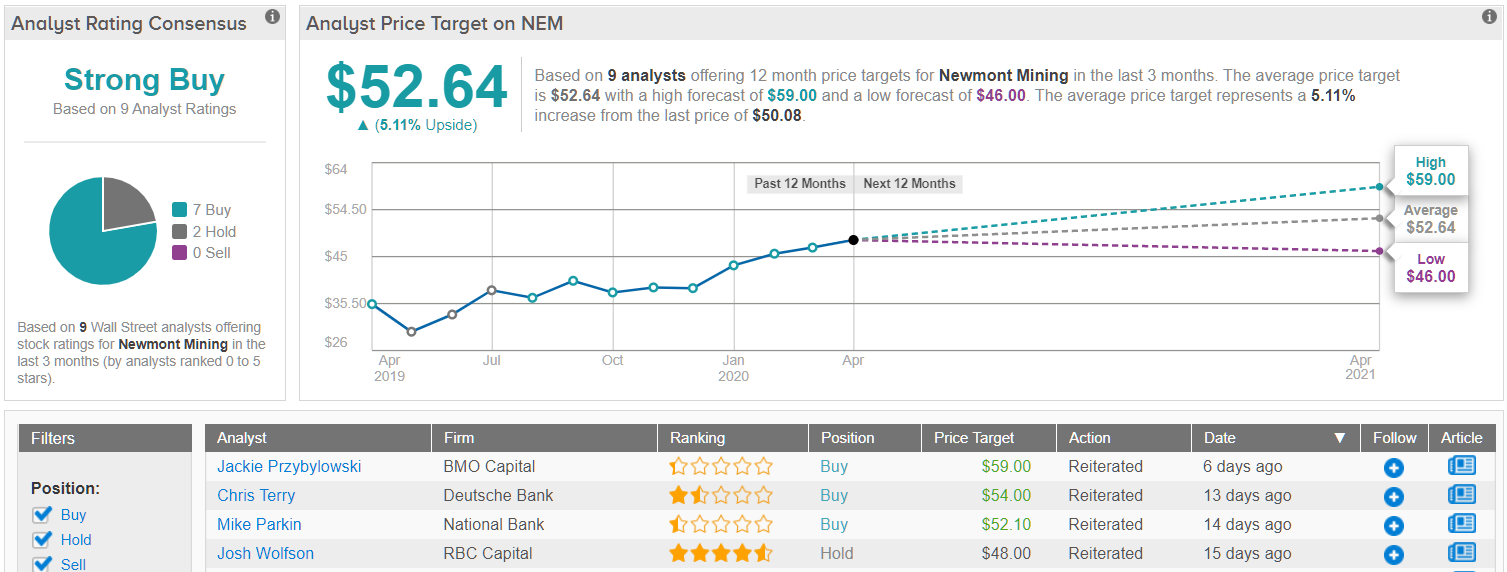

Morningstar rating overall rating equity precious metals category.

Prior to 7 29 19 this fund was known as dws multi asset global allocation fund.

The index is a rules based index composed of futures contracts on two of the most important precious metals gold and silver.

January 05 2007 shares are not fdic insured may lose value and have no bank guarantee.

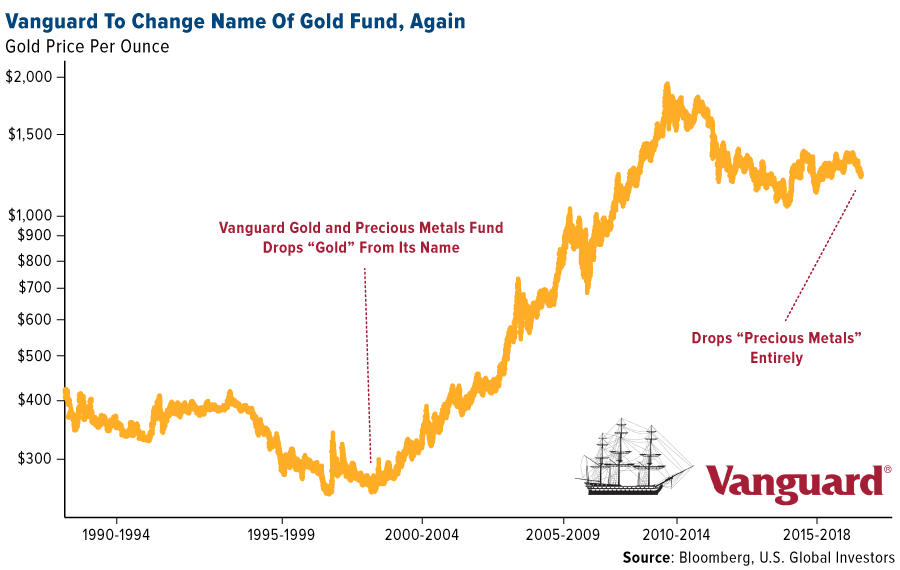

The gold and precious metals fund is the first no load gold fund in the u s.

The fund management objective strategy and risks also changed at that time.

Gold etfs had net inflows of 2 78mm oz or about 2 8 of total known gold etfs.

Gold bullion holdings are limited to 10.

A single page data sheet describing the franklin gold and precious metals fund s objective portfolio holdings and performance.